Senate Republicans are proposing the biggest tax cut in state history.

Historic budget surpluses call for historic tax cuts. You’ve said we need to give the surplus back, and we heard you loud and clear.

Our plan reduces the first-tier income tax rate from 5.35% to 2.8% and eliminates the state’s tax on Social Security benefits. It will provide $8.43 billion in tax relief to taxpayers over the next three years.

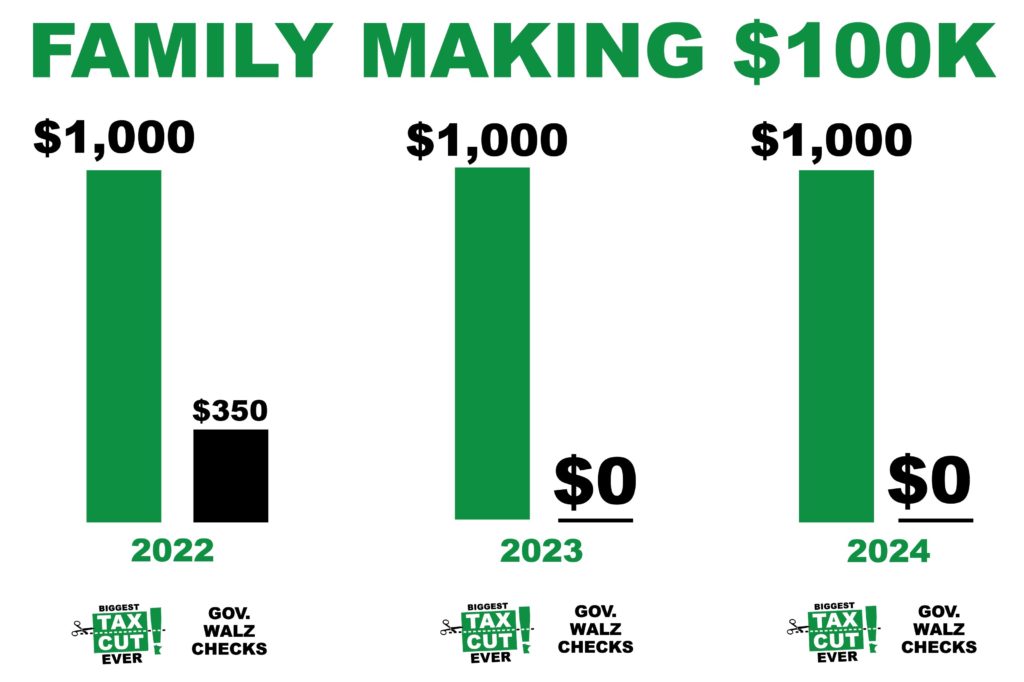

It is real, permanent, ongoing tax relief that makes your paycheck bigger week after week, month after month, and year after year. No election-year gimmicks.

While every family is facing its own unique challenges, we know they need relief, and they need it now. Families don’t need some big government program that picks winners and losers – they need relief.

On top of that – we want to see our seniors stay in our communities. There are too many ‘little Minnesota’ communities in lower-tax states like Florida, Texas, or Arizona. We want them to stay here and be part of our communities. We want them to spend time with their grandchildren and not have to count days on a calendar to qualify as a resident of a state with a better tax climate.

Government took too much money from taxpayers. It’s time to give it back.