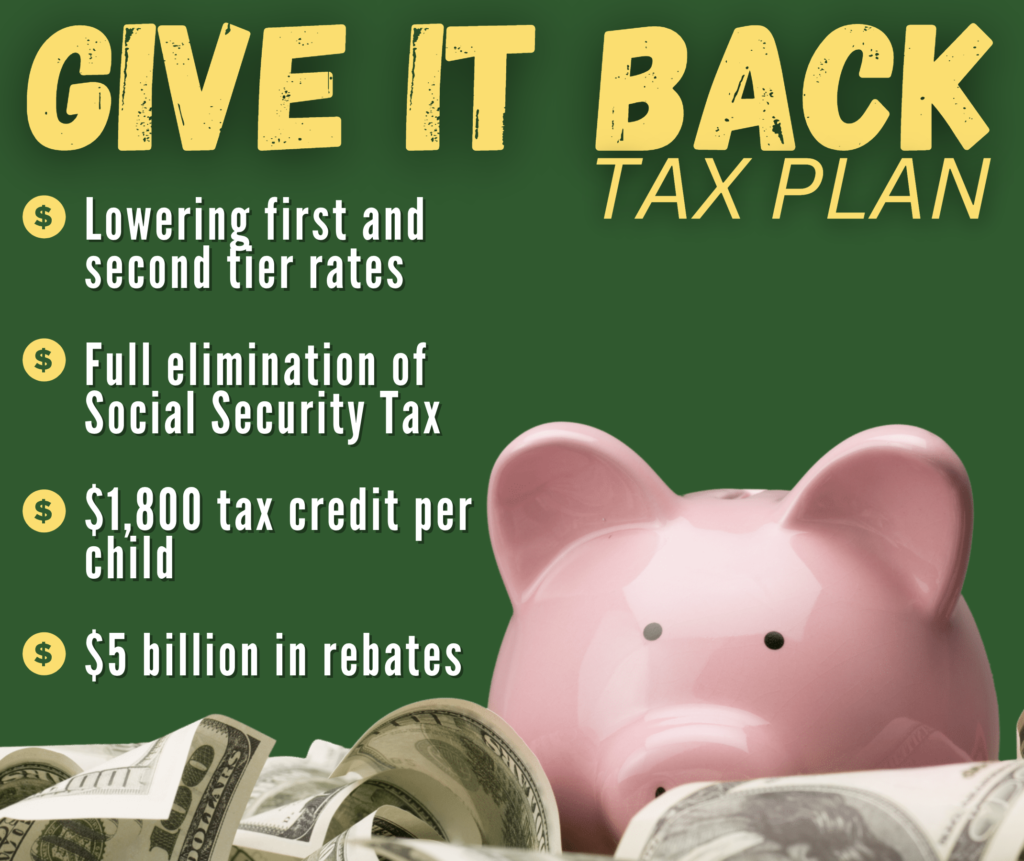

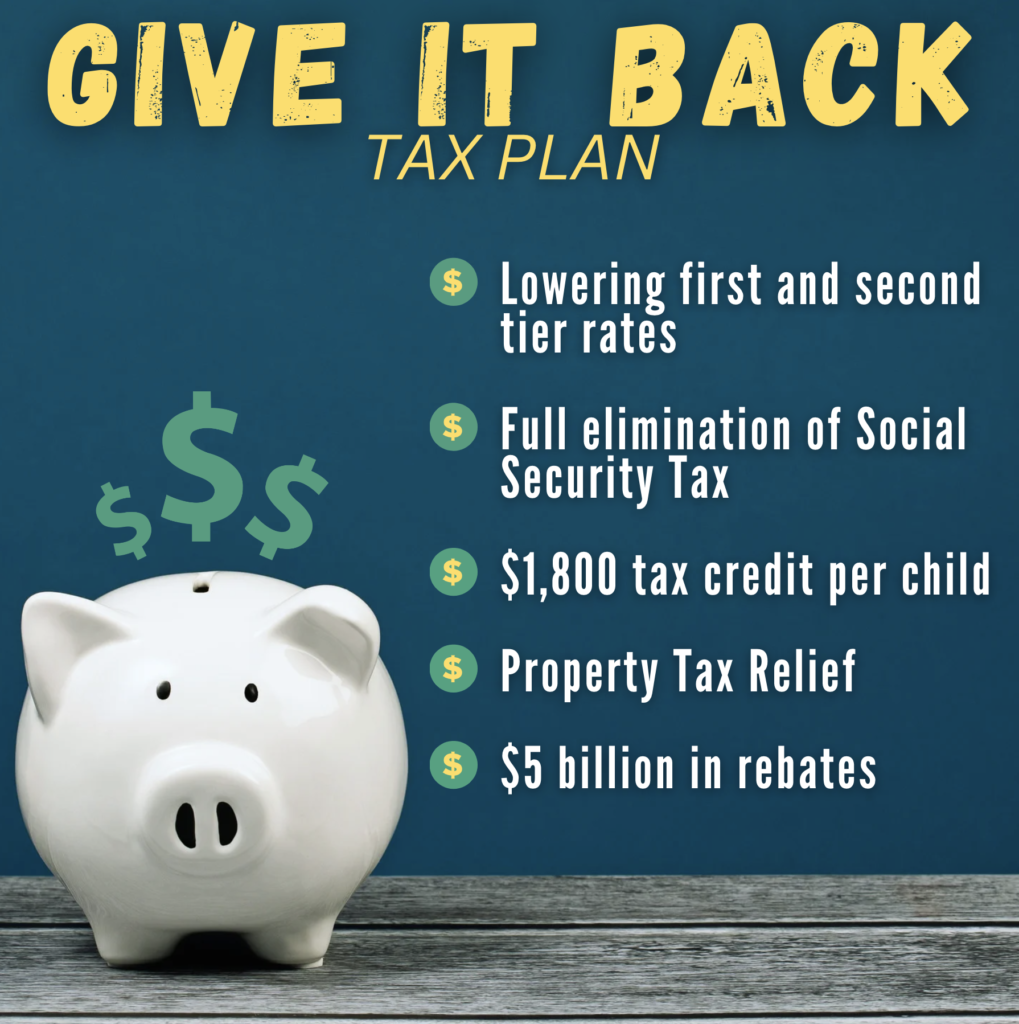

Your hard work created the state’s record surplus. You deserve it back.

A massive government surplus when people are hurting calls for us to pass tax relief that helps everyone.

Republicans are prioritizing returning the surplus to the hardworking taxpayers who created it and lowering the tax burden permanently, so taxpayers have more money in every paycheck.