| May 10, 2021 |

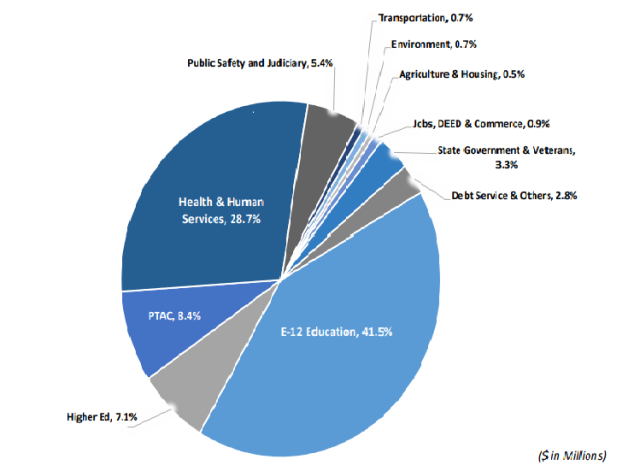

| Dear Friends, The Minnesota Legislature enters the last full week of its 2021 session. We are moving towards the May 17th deadline to have finalized a new two year balanced state budget. Presently, there are disagreements between the Governor Walz, DFL controlled House, and Republican led Senate regarding budget priorities. It is particularly challenging this budget cycle due to covid-19 meetings held remotely. This week, the MN House and Senate Conference Committees continue to meet (via zoom) to negotiate the two year state budget and some policy issues.  Here are a few key issues and where they stand: BUDGET Presently, the state has a projected $1.6 billion budget surplus. Plus, Minnesota is expected to receive $2.6 billion from federal government pandemic relief package. Minnesota’s current operating budget is $51.616 billion. The below pie chart shows where the state’s general fund is dispersed to state agencies.  Currently, negotiations continue on the crafting a new state budget. Below are proposed total amounts for a new two state budget. TAXES Even with a projected budget surplus, Governor Walz and House DFL-led want to raise taxes. Minnesota is already a high tax state and we certainly should not be raising taxes when we have a huge surplus and billions more coming in from the federal government. This helps Minnesotans recover from a year of shutdowns, business closures, and lay-offs so we can get people back to work. – Governor Walz proposes tax increases aimed at wealthy Minnesotans as well as higher taxes on corporations to provide increased spending on education and other programs. – House DFL- led Creates a fifth income-tax bracket of 11.15% for couples filing jointly who earn $1 million or more, or $500,000 and up for individual filers. Plus, proposing a new gas tax increase. – Senate GOP-led proposes tax relief for pandemic-related unemployment benefits and forgiven federal Paycheck Protection Program. Useful Facts and Figures from the Tax Foundation – Minnesota has the 7th Highest State and Local Individual Income Tax Collections Per Capita. – Minnesota’s LOWEST income tax bracket is higher than the HIGHEST tax bracket in 15 states with an income tax. (8 states do not tax income) – We currently have the 5th highest income tax bracket. If we adopted Walz’s proposal; we’d have the 3rd highest income tax bracket, only behind California and Hawaii. – Under the House proposal, Minnesota would be the 2nd highest behind California. Find me on Facebook! Make sure to follow my new legislative page on Facebook! You can find video updates, news from the legislature, photos, and more on my page. Click here. |