Friends and neighbors,

Aside from adjournment, this week was the best week of the legislative session – it was tax cut week!

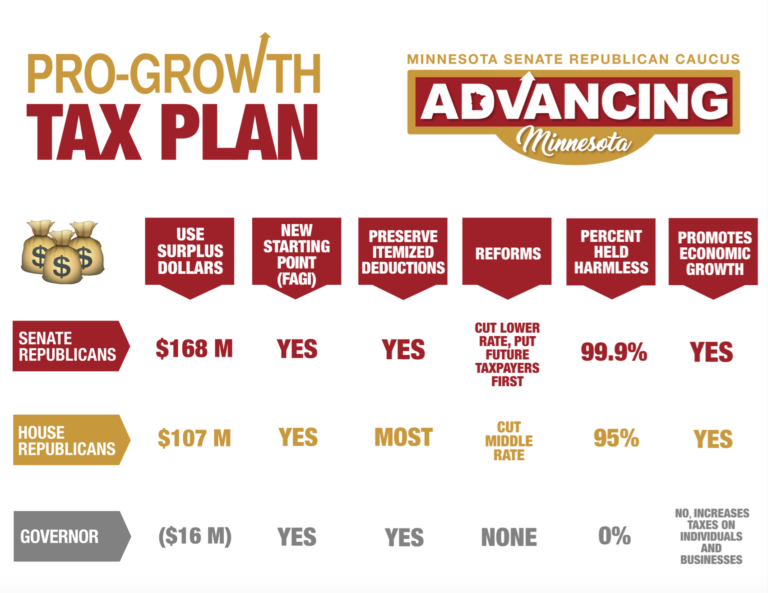

On May 3, the Senate passed a tax conformity plan that will cut taxes for 82% of Minnesotans, and at the bare minimum will hold 99.8% of tax filers harmless.

The plan has been in development for months. Minnesota was one of the states most heavily impacted by the landmark federal tax reform plan passed by Congress and President Trump last December. That bill benefited most families, but because of our onerous state tax code, a number of Minnesotans were facing unintended tax increases. We had to pass tax conformity to protect them, first and foremost.

So what is in our bill? Here are some details.

- It cuts the bottom tax rate from 5.35% to 5.1%. This tax rate cut will impact every Minnesota filer, but do the most good for low income families who need it most.

- It creates new tax triggers in our tax code. This innovative new mechanism puts taxpayers first when the state has surpluses. More on this in a minute.

- It preserves the state exemption of $4,150 and the state standard deduction of $13,000.

- It protects popular deductions like mortgage interest, state and local taxes, home equity loan interest, and charitable donations.

- It fully conforms to section 179 of the tax code – an important change that saves small business owners money.

Let’s talk more about tax triggers. This is a new idea to Minnesota, but it is being used in about 11 other states already.

It is simple: whenever the state has budget surpluses of certain sizes it will trigger automatic tax reductions. As long as healthy budget surpluses continue, so will these automatic tax reductions. The triggers will stop when rates have fallen one percentage point.

Our budget reserve and rainy day accounts are larger than they have ever been, and we already have automatic spending increases built into our budgets. But until now, nobody ever thought to put it in statute that the hardworking men and women of Minnesota should automatically get their money back when the state over-collects from taxpayers. This is the tax reform I am most excited about.

Our tax plan is also notable for what is not in it: an extension of the sick tax on health care services, which is set to expire next year. The governor keeps this regressive tax in place. As a result, his tax plan actually raises taxes on every single income level according to a recent Department of Revenue analysis. Every time you read that his plan reduces taxes, remember that statement is misleading because it does not include his sick tax extension.

The House passed their own version of a tax bill earlier in the week, so negotiations on a compromise will begin soon. I look forward to working with Governor Dayton to come up with a deal that benefits all Minnesotans.

If you have any questions about any of the tax plans being considered, please reach out to me any time.

Sincerely,