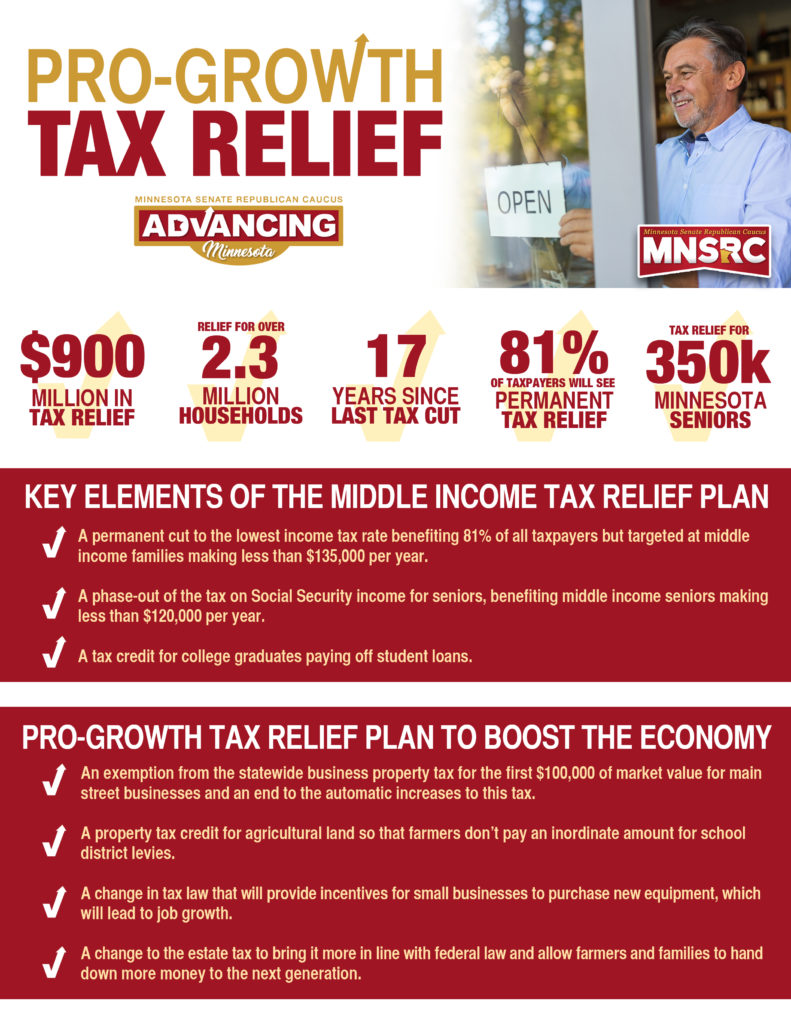

Minnesota Senate Republicans today unveiled a $900 million pro-growth tax plan that targets permanent relief to all taxpayers and provides a significant boost to the economy, especially in Greater Minnesota. The Senate Republican tax relief proposal is the marquee item in their Advancing Minnesota agenda and includes the first permanent cut in the income tax rate for middle class families since 2000. Over 2.3 million households representing 81% of all taxpayers will see immediate and permanent tax relief. The plan also contains significant property tax relief for businesses in Greater Minnesota to boost the economies of regional centers and small towns.

Minnesota Senate Republicans today unveiled a $900 million pro-growth tax plan that targets permanent relief to all taxpayers and provides a significant boost to the economy, especially in Greater Minnesota. The Senate Republican tax relief proposal is the marquee item in their Advancing Minnesota agenda and includes the first permanent cut in the income tax rate for middle class families since 2000. Over 2.3 million households representing 81% of all taxpayers will see immediate and permanent tax relief. The plan also contains significant property tax relief for businesses in Greater Minnesota to boost the economies of regional centers and small towns.

“The goal of this bill is simple: to Advance Minnesota’s economy through meaningful tax relief and reform, in order to create new opportunities for everyone,” said Sen. Roger Chamberlain (R-Lino Lakes), Chair of the Senate Tax Committee. “Minnesota will be facing significant challenges in the coming years so we have to be prepared by making sure family budgets are secure and our economy is strong.”

“After two years without a tax bill the people of Minnesota want relief,” added Senate Majority Leader Paul Gazelka (R-Nisswa). “This bill is about empowering people not government and rewarding work, families, and communities.”

Key elements of the Senate Republican middle income tax relief plan:

- A permanent cut to the lowest income tax rate benefiting 81% of all taxpayers but targeted at middle income families making less than $135,000 per year. Cutting the lowest rate ensures almost every taxpayer essentially receives the same tax break.

- A phase-out of the tax on Social Security income for seniors, benefiting middle income seniors making less than $120,000 per year. Thirty-eight states already exempt Social Security from taxation altogether. This change could benefit 350,000 Minnesota seniors who rely on additional sources of income to supplement their Social Security benefits.

- A tax credit for college graduates paying off student loans. Many young college graduates cannot afford a down payment on their first home because of overwhelming student loan debt so this credit will lessen that burden and spur economic activity. Minnesota ranks 5th in the nation for highest student debt.

Key elements of the Senate Republican pro-growth tax relief plan to boost the economy, especially in Greater Minnesota:

- An exemption from the statewide business property tax for the first $100,000 of market value for main street businesses and an end to the automatic increases to this tax.

- A property tax credit for agricultural land so that farmers don’t pay an inordinate amount for school district levies. Small school districts have had trouble passing school referendums because the cost falls disproportionally on agricultural properties.

- A change in tax law that will provide incentives for small businesses to purchase new equipment, which will lead to job growth. Changing the Section 179 depreciation schedules will allow businesses to receive tax benefits earlier than current law.

- A change to the estate tax to bring it more in line with federal law and allow farmers and families to hand down more money to the next generation.

The last time one of Minnesota’s major tax rates actually saw a cut was seventeen years ago. Income taxes, sales taxes, gas taxes and property taxes have all gone up during that time, but never down. The Senate Republicans’ plan will Advance Minnesota’s economy by letting families and businesses keep more of the money they earn with a tax relief package that delivers permanent tax relief for every taxpayer, without picking winners and losers.

“Lower taxes put more money into the economy to promote business investment, innovation and higher productivity so all Minnesotans can take care of their families,” added Gazelka.